A recent high court case has examined the approach taken towards valuing passive income streams for the purposes of a divorce.

In the case of CB and KB, the husband, who had been married to his wife for 14 years and together for 19 years in total, is a musician in a famous and very successful band. He had been in the band since 1994 and its first record deal was signed in 1999. There had been a total of seven albums released since that time and the band had been extremely successful.

The husband had five income streams from his music. Just one of those could be said to be require active involvement, that being touring with the band, from which he received a share of ticketing and merchandising income.

The other four streams of income all derived from music already composed and performances already carried out and recorded:

- Royalties from his own compositions

- Neighbouring rights, i.e. broadcast from radio and tv

- 33% of the royalties from the lead singer’s compositions

- His share of the recording royalties

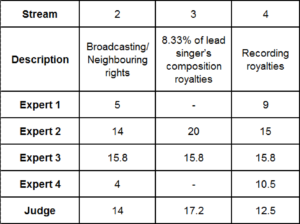

The court was faced with trying to attach capital values to each one of those four passive income streams. For that purpose, four industry experts were called to provide evidence: the band’s own manager, a single joint expert accountant witness and two further accountants, one for the wife and one for the husband. Whilst they agreed on the approach to be taken to stream 1, for example, they each had quite different views on many aspects of the other income streams, to include the appropriate multipliers that should be used.

This is not uncommon when dealing with industry specific and quite unique forms income. There can be much discretion applied from industry experts when trying to attach a capital value to such income streams, particularly in performance arts.

Mr Justice Mostyn heard evidence from all of the witnesses, two of whom gave their evidence together in a rare quite creative process known as hot tapping, where witnesses sit in the witness box together and cover each of the topics in a more conversational way. Mr Justice Mostyn then gave his own view on the appropriate multiplier to be adopted for each of the income streams in question as follows:

Using that multiplier he derived capital values which were added to the other capital assets in the case. The judge then ordered that the wife should be entitled to half of the total capital.

This case demonstrates the ability of the court to take account of all manner of complicated income sources in quite a creative way to provide spouses with a fair share.

Our solicitors are well versed in this and able to guide our clients through the process. We understand the methods used and the approaches to be taken to bring about a fair outcome for a couple.