Debt Recovery

Cash flow is paramount to the success of any business – big or small – and debt recovery can be key.

Debt collection isn’t always straightforward. Some debtors will do anything they can to avoid paying what they owe, and delays – deliberate or otherwise – can mean losing money.

Proven expertise with the legal routes to recovering debt

Sometimes, debt recovery means successfully obtaining a court judgement against your debtor, but even this might not be the end of the story. You may then need to enforce the judgment through the court, or via some form of insolvency process. We have vast experience in debt recovery and enforcement, so we’re well placed to help, with one of the largest and most experienced litigation teams in the South West to call on if necessary.

Our approach to successful debt recovery

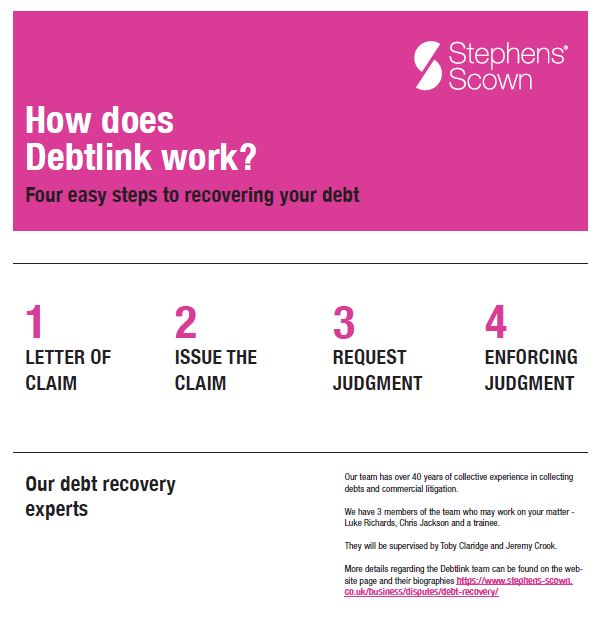

For straightforward debt cases, we offer recovery and collection through our DebtLink service, which can achieve debt recovery (plus interest) for as little as £70+VAT. Our initial written demand is usually enough to persuade repayment – more than half of debtors make payment upon receiving it.

If this doesn’t work, we can issue a claim on your behalf to recover the debt, which includes interest and, if possible, costs. This can mean the debt doesn’t end up costing you anything.

Commercial Dispute Resolution

If your debt is contested rather than repaid, we have other ways to help. Our experienced Commercial Dispute Resolution team can recover it for you as quickly and cost-effectively as possible.

Don’t let debt distract you from your business ambitions

We recover debts of all sizes for businesses of all sizes, allowing them to maintain focus on their future success.

Find out more about DebtLink costs.

How can we help you

"*" indicates required fields

By pressing send and providing your details you are agreeing to our Privacy Notice.

Once you submit your enquiry we will forward to the correct legal team to get in touch as soon as possible.

Related Services

- Commercial Disputes

- Business Owners Disputes and Exit Strategies

- Construction Disputes

- Property Litigation

Downloads

Team Leader