Today, the Chancellor of the Exchequer, Rt Hon Rachel Reeves MP presented some expected changes with the Autumn Budget, with Capital Gains Tax and Stamp Duty Land Tax being the focus of this article.

Capital Gains Tax

Capital Gains Tax is charged on the profit made from the sale of assets that have increased in value, for example, second homes or investments. It is paid by individuals and some business owners.

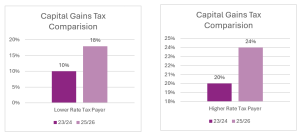

Labour have confirmed that Capital Gains Tax (CGT) will rise for lower rate tax payers from 10% to 18% and for higher rate tax payers from 20% to 24%.

The rates on residential property will remain at 18% and 24% respectively.

The implementation date for the CGT increase is 05 April 2025. If you are thinking of selling and wish to reduce your CGT liability, time is limited.

Stamp Duty Land Tax

Stamp Duty Land Tax is paid if you buy property or land over a certain price in England and Northern Ireland.

Labour have confirmed that stamp duty land tax for second homes, will increase from 3% to 5% from tomorrow.

This means that if you were hoping to save money on your holiday home purchase, you are sadly too late!

Your Property Investments

If you are viewing the budget positively and sitting tight on your property investments, you should still consider the ways you could futureproof your investment and make them more attractive to the tenant market, despite a potentially challenging economic climate.

Some suggestions:-

- Offering sustainable office solutions by investing in green building technologies, for example energy efficient lighting, solar panels, and sustainable materials – by operating at cheaper running costs, the saving could be passed on to a tenant, giving you an edge over competitors when it comes to service charge costs.

- Offering flexibility in the lease so that a tenant is able to share or sublet the premises from the beginning of the term.

- Creating flexible space that can be easily reconfigured without expensive Landlord consents and works.

- Considering shorter leases or the option to flex the demise of the lease in order to meet the evolving needs of tenants, while you maintain steady rental income.

- Offering premises that differentiate your property from others on the market. For example, offering a concierge service, gym, café, maybe even a nursery provision, essentially anything which enhances a tenant’s experience and helps to foster commitment to your property over others on the market.

If today’s Budget has left you concerned about your property portfolio, or if you are excited for more investment, contact the Commercial Property team on 0345 450 5558 or enquiries@stephens-scown.co.uk